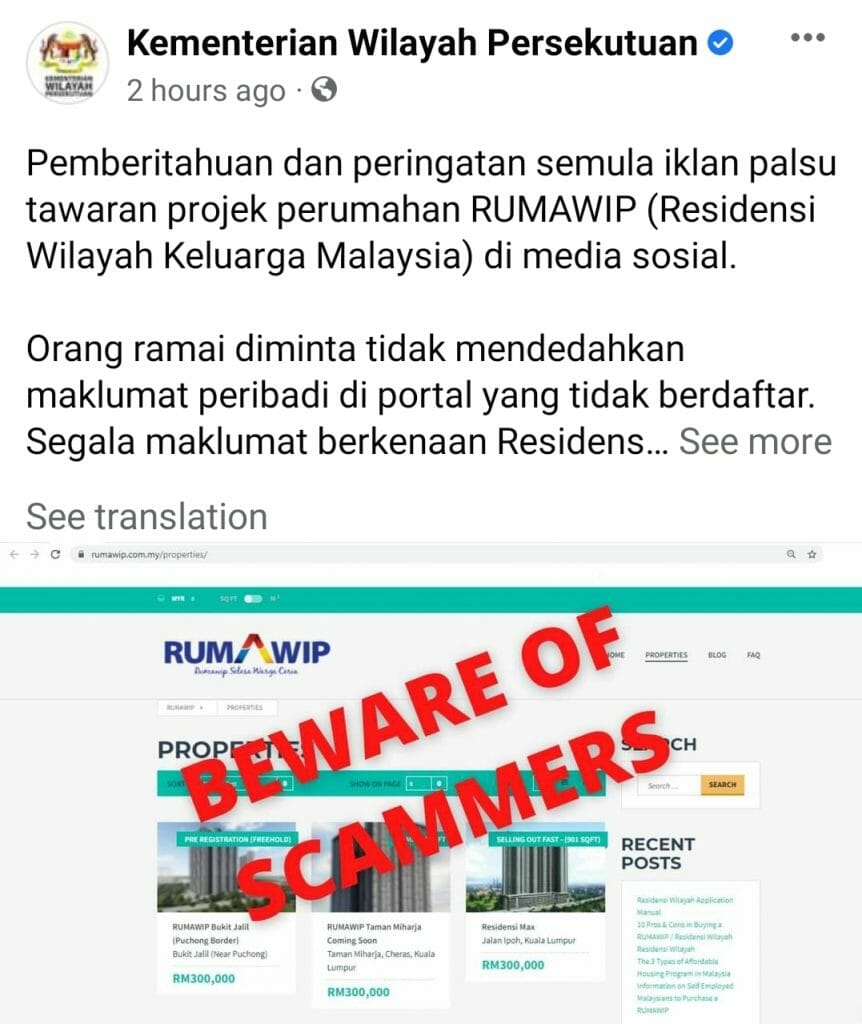

scammer noun informalUK /ˈskæm.ər/ US /ˈskæm.ɚ/ someone who makes money using illegalmethods, especially by trickingpeople https://dictionary.cambridge.org/dictionary/english/scammer FIRSTLY WE ARE NOT FROM ANY GOVERNMENT AGENCY OR DO WE PROCLAIM TO BE RELATED TO BE LINK WITH THE GOVERNMENTSECONDLY WE HAVE NOT OR WILL...

Uncategorized

USER MANUAL PORTAL RESIDENSI WILAYAH Residensi Wilayah Portal User Manual 1 CONTENTS 1. INTRODUCTION ............................................... .................................................. ... 2 2. REGISTRATION AND LOGIN OF APPLICANTS ........................................... ... 3 3. APPLICANT PROFILE / PROFILE UPDATE ..............................................

Pros 1) Low Upfront Most of the RUMAWIP / Residensi Wilayah buyers are first time house buyer which is eligible to apply for My First Home Scheme which is 110% financing for the first home provided applicant salary is RM 5,000 and below, which the regulation Bank Islam and MBSB can DISREGARD (if they were in the panel for the project). The Full Stamp Duty Exemption will last until 31 December 2025,...

MESSAGE FROM THE MINISTER OF FEDERAL TERRITORIES MESSAGE YB TUAN HAJI KHALID BIN ABD. SAMAD MINISTER OF FEDERAL TERRITORIES Ministry of Federal Territories (KWP) is very concerned about preparation a more comfortable affordable home to the citizens of the Federal Territory. The Ministry is committed towards building as many as 80,000 units of affordable housing in the Federal Territory to support...

1) Residensi Prihatin – Apartment that cost RM 200,000. Pros Mortgage payment – Average RM 775 for 100% financing, 35 yearsControlled Pricing for Additional Parking Lot – RM 15,000 for tandem parking lot & RM 18,000 for side-by-side parking lot. (Maybe able to be included in loan)Controlled Pricing for Maintenance Fee – 12 Cent per SQFT (Very cheap)Booking fee cap at RM 1,000 & must...

Moving forward, due to the pandemic that will definitely decrease the jobs available in the market, we will see the increase of freelancers like Influencers, YouTubers, Online Businesses, Entrepreneurs or any work that is self created in Malaysia. The demographic of this group of people will largely consist of millennials that would not bow down in defeat towards the coming...

Covid-19 Stimulus Incorporation Package at RM2,599 (Worth RM6,200). The economy has slowed down after the pandemic, and to revitalise the economy, our government has come out with a policy to encourage incorporation. New incorporation now gets to enjoy RM20,000 tax rebate annually for a consecutive of 3 years. And, to support the plan, Cheng & Co has designed a package particularly for...